SurplusInterconnectionin Virginia

Accelerating Clean Energy Deployment by Leveraging Existing Grid Infrastructure

Virginia's clean energy transition faces critical interconnection bottlenecks despite ambitious goals

The Problem

Interconnection Delays

Virginia has ~248 GW of active projects in the PJM interconnection queue, with average connection timelines exceeding 6 years— over 40 months to reach interconnection agreement, plus 2+ years for construction.

Tightening Supply Conditions

Virginia's electricity markets face substantial capacity challenges. PJM's 2026/27 capacity reached the price cap at $329.17/MW-day (11.4× increase from previous years) in the Dominion zone. PJM capacity reserves have tightened significantly, reflecting accelerating demand growth from data centers and electrification alongside thermal plant retirements.

New Gas Supply Challenges

New gas plants ordered today won't come online until 2030-2031 at earliest, creating a critical gap in meeting near-term capacity needs. Additionally, capital costs have surged: recent combined-cycle projects now cost $2,000/kW or more, up from $1,116-1,427/kW for 2026-2027 projects, making new gas generation increasingly expensive as a response to growing electricity demand.

Economic Opportunity Loss

Virginia faces growing economic development constraints as U.S. electricity demand is projected to increase 25% by 2030 and 78% by 2050, driven by data centers, AI infrastructure, and industrial electrification. With power availability now the primary site selection factor for data centers, Virginia's strategic position in PJM territory creates unique opportunities. However, extended interconnection timelines and tightening capacity conditions limit the state's competitiveness for these high-value investments.

The Solution: Surplus Interconnection

Surplus Interconnection for Virginia

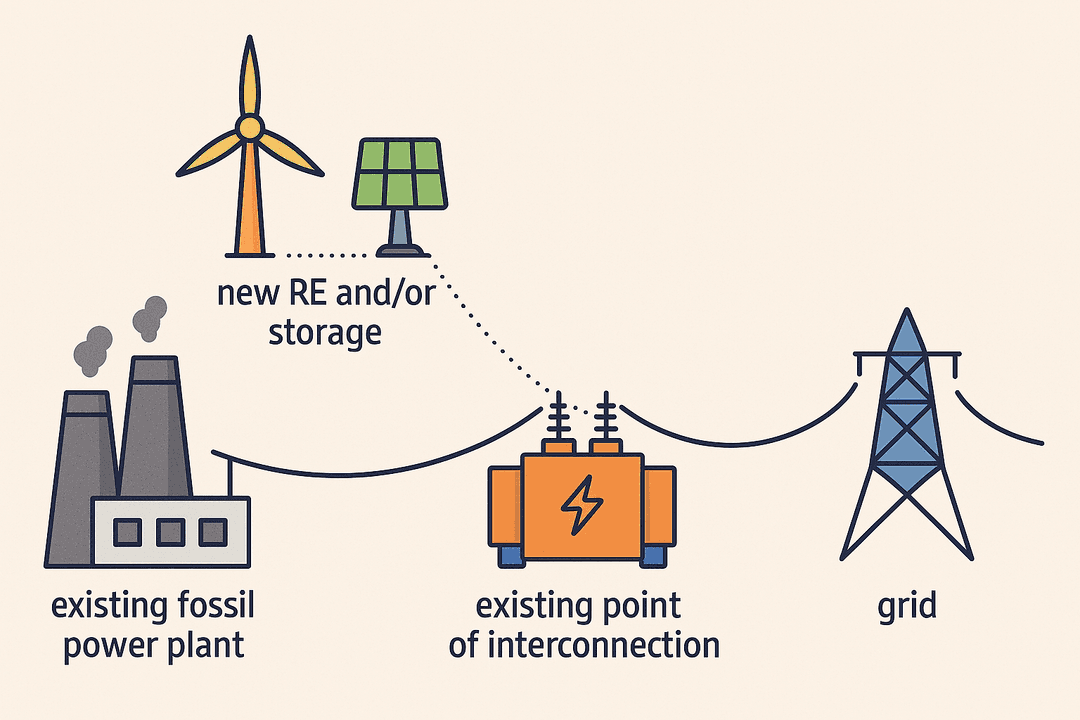

Surplus Interconnection Service allows new electricity supply resources to connect to the grid using existing infrastructure that serves already operating generators, without exceeding the total output capacity already allocated to the existing resource. FERC Order 845 (2018) cleared a regulatory pathway for generators to add new electricity resources to the grid by utilizing surplus capacity at existing interconnection points.

Key Results

Available Surplus Capacity

Virginia can add significant clean energy capacity through surplus interconnection, at thermal plants and renewable plants enabled by battery storage—all at existing sites without new transmission.

Cost Savings

Surplus interconnection can save $1.9 billion in interconnection costs by leveraging existing infrastructure, equivalent to $565 per Virginia household. This conservative estimate only accounts for interconnection savings—additional benefits from co-location and transmission utilization would increase total savings significantly.

Fast Deployment

Surplus interconnection projects can be completed in 12-18 months compared to 4-5 years for standard queue projects. PJM's surplus process follows a streamlined study approach, enabling rapid deployment when no network upgrades are triggered.

Thermal Interconnections

Virginia has significant thermal capacity, with plants operating at less than 15% capacity factor (mostly gas peakers), leaving grid connections idle most of the time. By 2030, building new solar will be cheaper than operating existing thermal plants, even without IRA tax credits. By co-locating solar and wind at these sites, we can bypass lengthy interconnection queues and deploy clean energy using existing infrastructure.

Key Results

Abundant Local Resources

~679 GW PotentialOver 679 GW of combined solar (607 GW) and wind (73 GW) potential exists within 6 miles of Virginia's thermal plants. This enormous renewable resource can enable clean energy deployment at existing interconnection points.

Urban Area Plants

1.6 GW Capacity15 thermal facilities with 1.6 GW capacity are located in areas with >10% urban land cover. These plants may face siting constraints but are candidates for adding battery storage after thermal plant retirement.

Economic Crossover

17.6 GW by 2030By 2030, building new solar will be cheaper than operating 17.6 GW of Virginia's existing thermal plants (100% of total thermal capacity), even without IRA tax credits. Currently, solar is already cost-competitive with 9.9 GW of thermal capacity.

Total RE Integration Potential

~8 GW by 2030Approximately 8 GW of solar can be economically integrated at Virginia thermal plants by 2030, using existing grid connections and avoiding lengthy queue delays.

Quick Wins Available

12.4 GW Ready12.4 GW of thermal capacity operates at less than 15% capacity factor, and 76% of Virginia's thermal capacity operates below 30% CF, creating immediate opportunities for surplus interconnection.

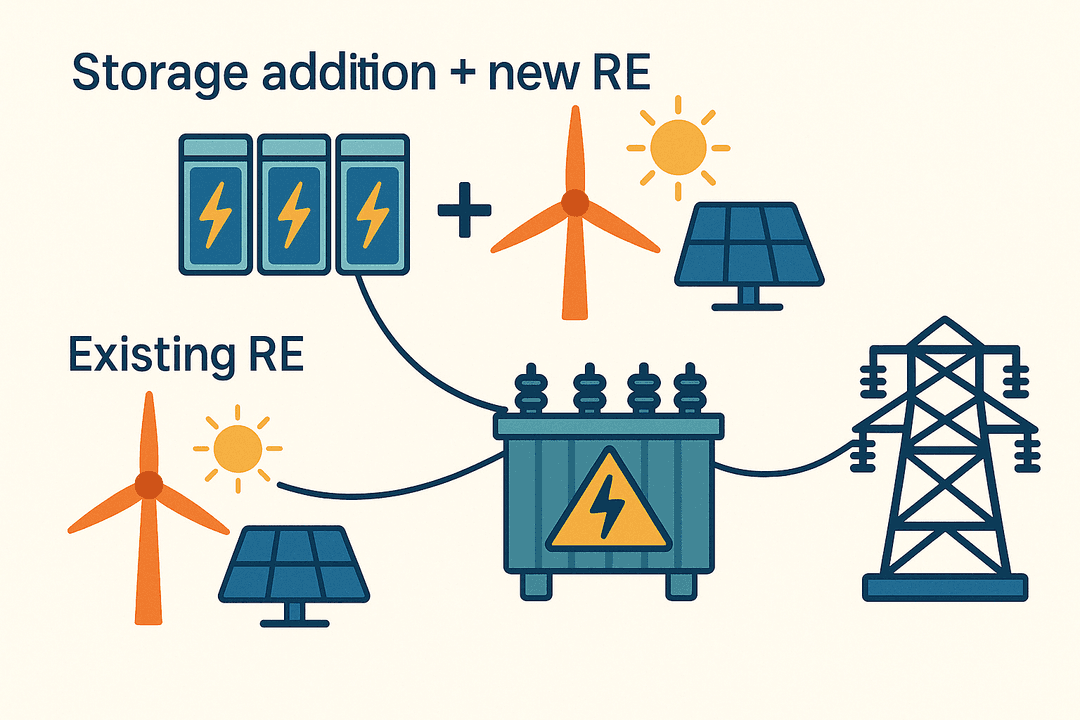

Renewable Interconnections

Virginia's existing renewable capacity operates at low capacity factors—meaning interconnection capacity sits idle most of the time. Adding battery storage can enable additional renewable capacity and dramatically increase capacity factors, effectively turning variable renewables into firm power resources.

Key Results

Renewable Resource Potential

~877 GW TotalVirginia's existing renewable sites have approximately 877 GW of combined solar (783 GW) and wind (94 GW) resource potential within 6 miles of existing RE plants, representing enormous opportunity for expansion.

Battery Storage Integration

~4.5 GW of 6-Hour StorageAdding approximately 4.5 GW of 6-hour battery storage (27.3 GWh) at Virginia's solar sites would deliver firm, dispatchable capacity - helping meet peak demand and enhance grid reliability.

Additional RE Capacity

~8.6 GW EnabledVirginia's existing renewable interconnections can support an additional ~8.6 GW of renewable capacity (~4.4 GW solar + ~4.1 GW wind) when paired with battery storage, with no new grid connections required.

Maximized Utilization

~70% Average CFDeploying storage and additional renewables at existing interconnections dramatically improves capacity factors from 27% to approximately 70% on average. This transforms intermittent renewables into firm resources comparable to gas CCGT plants.